Understanding the Statement of Cash Flows

By: Valerie Briley, CPA, Founder & Chief Business Driver and Maggie Regalia, CPA, Director of Business Development, Reveal Business Solutionses

“My income statement shows that I made $250K this year but I only have $100K in my bank account. Where did the rest of the money go?”

I am frequently asked some version of this question by small business owners who are surprised to learn their net income doesn’t equal their cash balance. I actually love this question because it’s an opportunity to help business owners understand something that is often overlooked yet is crucial to their success – the importance of the Statement of Cash Flows.

Cash is constantly flowing in and out of most businesses. The cash balance reflects the activity since the day the bank account was opened – regardless of whether the cash inflows were related to revenue or from a bank loan, or whether the cash outflows were related to expenses or distributions to the owner. Depending upon the type of cash inflow/outflow, it may be the result of operations (reflected on the Income Statement) or not (reflected on the Balance Sheet). Also, when we’re talking about the accrual basis, revenue is recorded when it’s earned, not when the cash is collected. Likewise, expenses are recorded when they’re incurred, not when the cash is paid out. There are often significant timing variances that can lead you to misinterpret your cash position at any given time.

As a business owner, it’s critical to understand the flow of cash so that you know you’ll have cash on hand when you need it, or that you may need to contribute cash or draw on your line of credit in the future. In research conducted by U.S. Bank, they found that 82% of small business failures could be attributed to poor cash flow management. Since you can’t get an accurate picture of your cash position from the Income Statement, and you likely don’t have time to monitor every single cash transaction, it’s beneficial to understand how to read and interpret your Statement of Cash Flows.

Statement of Cash Flows is One of Three Core Financial Statements

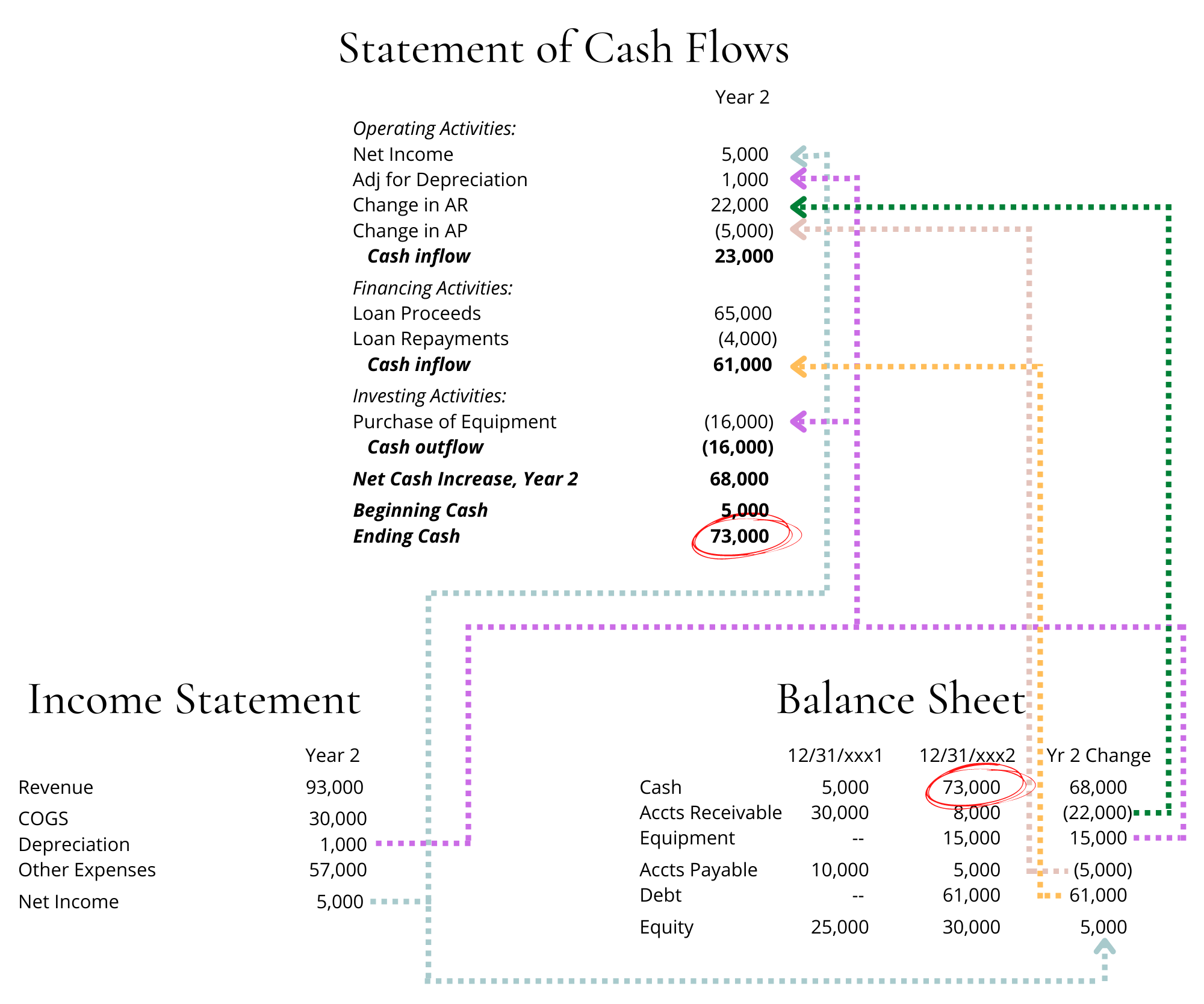

The Statement of Cash Flows is a financial report that provides detailed information about the money flowing into and out of a business. It is probably the least understood of the three core financial statements you need to run your business. Today we’re focusing on the Statement of Cash Flows but for context, here’s a brief description of all three:

- Statement of Cash Flows shows cash inflows and outflows by category over a period of time.

- Balance Sheet provides a snapshot of business assets, liabilities, and equity (or net worth) at a specific point in time.

- Income Statement shows revenues, expenses, and profit (or loss) over a period of time.

Breaking Down Cash Flow

We’ve all heard the term “Cash is King.” Without it, your business is insolvent. Your Statement of Cash Flows allows you to see how cash is moving – where it’s coming from, where it’s going, and how much you have on hand. The statement is broken down into the following three categories:

- Operating Activities start with your net income, which we know is derived from revenues and expenses. However, as noted above, there can be significant timing differences between revenue/expense and cash inflow/outflow. These timing differences are reflected in the Operating Activities section. For example, let’s say you give your customers 30-day terms. You have $30k of sales in April, but only $10k of that was actually collected in April. Conversely, you collected $40k of sales from prior months in April. While your Income Statement shows $30k of sales, your Statement of Cash Flows adjusts that for the change in accounts receivable, which was in effect a total $50k cash increase ($30k sales – $20k not collected + $40k from prior months = $50k). Net income is also adjusted for non-cash revenue or expenses, such as depreciation expense or investment gains/losses.

- Financing Activities summarize transactions involving debt or equity. If you take out a line of credit from a bank, your aunt lends you start-up money, or you contribute money into the business yourself, that cash inflow shows up here. The outflow shows up here when those loans are repaid or when you distribute money to yourself. This also reflects the inflow/outflow of cash if your business loans money to a shareholder or third party and they are repaying in installments.

- Investing Activities include information about the purchase or sale of long-term assets, such as property, buildings, vehicles, furniture, or equipment. It also includes less common investment activities such as the acquisition of another company. These are all activities that involve an inflow or outflow of cash related to assets, not revenue or expenses.

Track Cash Flow so You Have It When You Need It

Did you ever feel surprised or frustrated that you didn’t have cash on hand even though business was good? Have you ever had to scramble to cover payroll or a large bill that was due? The Statement of Cash Flows helps you understand what causes cash flow problems like these, so you can take corrective action. For instance, a cash flow statement can tell you if you’re paying your vendors too quickly, or if you’re collecting receivables too slowly, either of which can restrict cash flow. By taking full advantage of vendor terms and holding your customers accountable for paying you on time, you can maintain positive cash flow, which ensures you have cash on hand when you need it. The Statement of Cash Flows can also help you better plan for large equipment purchases. You may have the cash on hand and decent profits, but you need to also consider whether your key vendors have been paid so you don’t put your business in a tight spot.

A Solvent Business is a Healthy Business

A Statement of Cash Flow is a valuable tool every business owner should take advantage of. Let’s face it – it’s a lot less stressful to pay bills when you know you have money in the bank to cover your costs.

If you have questions or concerns about your cash flow, call us at Reveal Business Solutions. We partner with small- and medium-sized business owners around the country to support the growth and profitability of their companies. We can help you understand your cash flow and, when needed, suggest actions you can take to make sure your business is always solvent.